EVA (Economic Value Added) and ROIC (Return On Invested Capital)

At the Annual General Meeting held on March 21, 2025, Kao Corporation received questions from shareholders regarding EVA (Economic Value Added) and ROIC (Return on Invested Capital). Given our commitment to transparent communication with the financial community, we are providing additional detail on how we use and calculate these metrics.

1. Target Management Metrics

The Group uses EVA and ROIC as primary management metrics. The Group adopted EVA as a management metric in 1999 and has been promoting “EVA management” since its adoption. ROIC was introduced as a key management metric in August 2023 as part of our mid-term plan “K27.” The purpose of both indicators is to focus management on efficiently utilizing capital to generate profits from the perspective of shareholders and other capital providers. We believe that continuously increasing EVA leads to an increase in corporate value, which is in the long-term interests of all stakeholders. In our business, we use EVA for investment evaluations, annual performance management, and compensation systems with the aim of growing our business. Furthermore, we aim to deepen EVA management by strengthening business portfolio management through ROIC. ROIC raises awareness of capital costs in each business and enables management to better consider each business’s financial and operational characteristics and competitive environment. By emphasizing capital efficiency along with profits for each business, we aim to improve EVA through focused investment in growth businesses and thoughtful portfolio improvements.

2. Definitions and Calculation Methods of Metrics

The definitions and calculation methods of EVA and ROIC are as follows:

| Definition | NOPAT | Invested Capital | |

|---|---|---|---|

| EVA | The absolute amount of value creation exceeding capital costs (expressed in monetary value) | Net income + After-tax interest expense + Other one-time expenses (e.g., structural reform costs) |

Total equity + borrowings+ Bonds + Part of other financial liabilities*1 + Previously amortized goodwill and others*2 |

| EVA = Adjusted NOPAT - (Adjusted Invested Capital*3 × WACC*4) | |||

| ROIC | The productivity of total investment (expressed as %) | Net income + After-tax interest expense |

Total equity + borrowings + Bonds + Part of other financial liabilities*1 |

| ROIC = NOPAT / Invested Capital*3 | |||

EVA and ROIC differ in the definitions of invested capital and NOPAT (Net Operating Profit After Taxes) used in the calculation process. EVA may capitalize and add one-time expenses such as restructuring costs to NOPAT to promote sustainable corporate value growth. Additionally, invested capital may include amortized goodwill and one-time expenses added to NOPAT. In the future, if one-time expenses are added, EVA will be labeled as “adjusted.”

-

* 1 Excluding lease liabilities.

-

* 2 Under previous Japanese GAAP, goodwill (and other items) that had already been amortized continued to be reflected in invested capital for our EVA calculation. This approach ensures that even investments that have been previously written off in our accounting records are still considered part of invested capital. By establishing a “high hurdle,” we rigorously assess whether our company is genuinely generating value that surpasses this threshold.

-

* 3 Average value at the beginning and end of the relevant fiscal year.

-

* 4 Calculated at the current rate of 5%.

3. Setting and Utilization of WACC in EVA

The capital cost rate used in EVA calculation is WACC (Weighted Average Cost of Capital), which is set based on the following considerations since EVA was introduced in 1999:

- Annual verification of the calculation and key inputs with external experts’ advice and independent data based on CAPM (Capital Asset Pricing Model)

- Stability considerations for medium- to long-term investment decisions

- Currently judged to be a reasonable level of 5% for Kao Group, with consistency confirmed with external data

4. ROIC Calculation Method

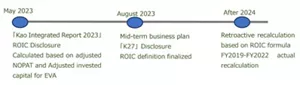

Since August 2023, we have been using ROIC as a management metric as part of our mid-term management plan “K27.” The ROIC disclosed in the “Kao Integrated Report 2023” issued in May 2023 was calculated based on the same Adjusted NOPAT and Adjusted Invested Capital used for EVA. Therefore, the ROIC figures in that report differ from those presented afterwards. From August 2023 onwards, we have recalculated both past performance values and the target values of “K27” using the consistent calculation formula mentioned above and have disclosed them accordingly.

5. Enhancing Transparency and Disclosure

In the future, we will enhance explanations of EVA and ROIC components (NOPAT, invested capital, WACC, etc.) using diagrams, figures, and FAQ formats in integrated reports and financial explanation materials. Additionally, if there are changes in the definitions or calculation methods of metrics, we will appropriately provide comparisons with previous definitions to ensure comparability and foster understanding.

6. Emphasizing Engagement with All Shareholders

We continue to value the diverse opinions of shareholders and will sincerely respond to any questions or concerns. We will continue to strive for transparent information disclosure and are committed to enhancing long-term corporate and shareholder value.