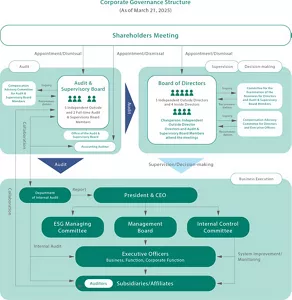

Corporate Governance Structure

Corporate Governance Structure

Board of Directors

The Board of Directors deliberates from various perspectives, including the evaluation of risks, on the overall direction of management including management strategy, and monitors from multiple viewpoints whether the management strategy is being properly implemented. It also puts in place an environment conducive to aggressive management that also clearly identifies risks, by establishing an internal control system and risk management system.

Audit & Supervisory Board

Composed of Full-time Audit & Supervisory Board Members who are familiar with the company’s internal matters, and Outside Audit & Supervisory Board Members who possess a high level of specialist expertise and know-how in the fields of finance, accounting or legal affairs, the Audit & Supervisory Board engages in in-depth discussion from an independent, objective viewpoint. The Audit & Supervisory Board Members realize effective auditing by attending important meetings, such as meetings of the Board of Directors and of the Management Board, as well as through coordination with the Accounting Auditor, the internal auditors of each division and the auditors of affiliated companies, and through the implementation of audits at individual divisions within the company and of surveys at affiliated companies.

Management Board

With a membership that consists mainly of personnel at Managing Executive Officer level or higher, the Management Board makes decisions relating to the execution of the mid- to long-term direction and strategy that has been deliberated on and decided on by the Board of Directors. Delegating wide-ranging authority to the Management Board helps to speed up decision-making and execution.

Committee for the Examination of the Nominees for Directors and Audit & Supervisory Board Members

Comprising all Outside Directors and one Outside Audit & Supervisory Board Member, this committee examines and deliberates on the appropriateness and other qualities of Director nominees, including nominees for the positions of Chair, President and Chief Executive Officer and Representative Director, as well as Audit & Supervisory Board Member nominees, and submits its opinions to the Board of Directors. In addition, the size, composition and diversity of the Board of Directors and Audit & Supervisory Board Members, the qualities and competencies required of the President and Chief Executive Officer, Directors and Statutory Auditors, and succession planning are discussed, and the results of the review are reported to the Board of Directors.

Compensation Advisory Committee for Directors and Executive Officers

The Compensation Advisory Committee is composed of all Outside Directors and President and Chief Executive Officer. The committee examines and deliberates on compensation systems and compensation levels for Directors and Executive Officers, and submits its opinions to the Board of Directors.

Compensation Advisory Committee for Audit & Supervisory Board Members

Comprising all Outside Audit & Supervisory Board Members, the President and Chief Executive Officer, and one Outside Director, this committee examines, from an external perspective, the appropriateness of the amount of compensation awarded to Audit & Supervisory Board Members by the decision of the Shareholders Meeting, and the transparency of the process by which this decision was made, and submits its opinions to the Board of Directors.

ESG Managing Committee

To gain the support and trust of all stakeholders, the ESG Managing Committee discusses and determines the direction of the group’s activities pertaining to the ESG Strategy, aiming to contribute to the sustainable development of the Kao as a company with a global presence, and of society. The concrete embodiment of ESG Strategy is promoted by the ESG Promotion Meeting, and developed through activities carried out by individual divisions. The overall direction of ESG activity is confirmed and adjusted as necessary by the committee based on the current state of company-wide ESG activity promotion and the recommendations received from the ESG External Advisory Board.

Internal Control Committee

The Internal Control Committee oversees and promotes internal control activities throughout Kao, with the aim of ensuring the accuracy of financial reporting and enhancing the quality of internal control establishment and operation through cross-organizational integration of functions pertaining to internal control.

Department of Internal Audit

The Department of Internal Audit reports directly to the President and Chief Executive Officer. It conducts internal audits on management activities of Kao and Kao Group companies in general from the perspective of complying with laws and regulations, the appropriateness of financial reporting and administrative effectiveness and efficiency. Besides providing reasonable assurance as to the effectiveness of the company’s internal controls, the department also aims to further enhance the internal controls system by proposing improvements. The results of internal audit activities are reported to the Management Board and the Board of Directors at regular intervals.

Regarding management of subsidiaries, the Group Company Policy Manual stipulates which items subsidiaries are required to obtain approval for from Kao in advance, and which items they are required to report to Kao. In accordance with the policy manual, the findings of internal audits conducted by the Department of Internal Audit, as well as initiatives implemented in response and the outcomes of such initiatives, are shared with the board of subsidiaries.

The Department of Internal Audit exchanges information and opinions regarding the current state of internal audit activities with Audit & Supervisory Board Members on a regular basis and as needed. In addition, with regard to the development or evaluation of internal controls relating to financial reporting and the current state of related internal audit activities, the Department of Internal Audit shares information as appropriate with the Accounting Auditor, and strives for effective mutual coordination with the Accounting Auditor.

Accounting Auditor

Deloitte Touche Tohmatsu LLC is the audit firm appointed as the Accounting Auditor based on the Companies Act, and for accounting audits based on the Financial Instruments and Exchange Act.

- Home

- About Kao

- Our Core of Management

- Corporate Governance

- Corporate Governance Structure and Initiatives

- Home

- About Kao

- Our Core of Management

- Corporate Governance

- Corporate Governance Structure and Initiatives