Compensation System for Directors, Audit & Supervisory Board Members, and Executive Officers

Compensation Objectives

The compensation standards and systems for Directors, Audit & Supervisory Board Members, and Executive Officers focus on the following objectives:

- Securing and retaining diverse, high-caliber talent to strengthen competitive advantage

- Driving unified efforts to sustainably enhance corporate value

- Aligning interests with shareholders

Compensation Structure for Directors, Audit & Supervisory Board Members, and Executive Officers

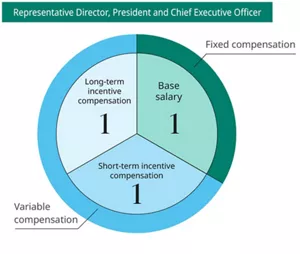

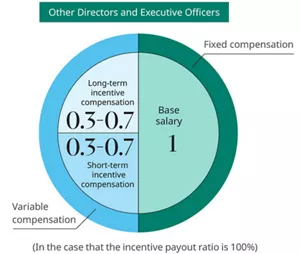

Directors (excluding Outside Directors) and Executive Officers receive a mix of base salary, short-term incentives, and long-term incentive compensation. Outside Directors and Audit & Supervisory Board Members receive a base salary only. To support ambitious Global Sharp Top targets in K27, the compensation structure is designed to encourage bold, strategic risk-taking.

Compensation Structure

- We set compensation levels for Directors, Executive Officers, and Audit & Supervisory Board Members based on annual reviews of standards at comparable major manufacturers.

- We use survey data from an external organization to review the compensation of Directors, Audit and Supervisory Board Members, and Executive Officers.

Summary of the Compensation System

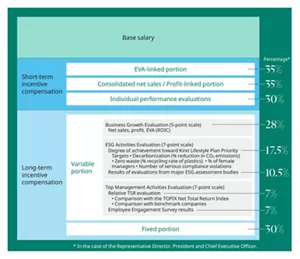

Short-term incentive compensation is based on target achievement within the fiscal year. Evaluation indicators include EVA, consolidated net sales and profit, as well as individual performance. Bonus payments range from 0% to 200%.

Long-term incentive compensation is designed to deliver shares, incentives and rewards that drive sustained corporate value. It includes a variable component (ranging from 0% to 200%) linked to mid-term targets, along with a fixed annual portion.

We will continue refining the system to enhance both motivation and transparency.

- The Board of Directors establishes the incentive compensation system and company performance evaluation after discussions with the Compensation Advisory Committee, which has a majority of Outside Directors.

- Individual performance for short-term incentive compensation component is evaluated as follows: Outside Directors assess the President and CEO, while other Directors are evaluated by the Compensation Advisory Committee.

Compensation Paid to Directors in FY2024

(million yen)

| Category | Number of members | Aggregate amount of remuneration, etc. |

Components of Remuneration | |||

|---|---|---|---|---|---|---|

| Base salary | Short-term incentive compensation (performance- based bonus) |

Long-term incentive compensation (Performance-based share incentive plan) |

||||

| Variable portion | Fixed portion | |||||

| Directors (including, in parentheses, Outside Directors) |

11 (6) | 821 (80) | 402 (80) | 207 (-) | 149 (-) | 63 (-) |

| Audit & Supervisory Board Members (including, in parentheses, Outside Audit & Supervisory Board Members) |

6 (4) | 127 (50) | 127 (50) | - (-) | - (-) | - (-) |

| Total (including, in parentheses, Outside Directors and Outside Audit & Supervisory Board Members) |

17 (10) | 948 (130) | 529 (130) | 207 (-) | 149 (-) | 63 (-) |

-

* 1 The above numbers of Directors/Audit & Supervisory Board Members include one Inside Director, two Outside Directors,and one Outside Audit & Supervisory Board Member who resigned at the conclusion of this 118th Annual General Meeting of Shareholders held on March 22, 2024.

-

* 2 The variable portion of the long-term incentive compensation (performance-based stock compensation) will be finalized on the final year of the applicable period of four fiscal years from 2024 to 2027 of the Mid-term Plan “K27.” As such, the variable portion equals the amount of provision for long-term incentive compensation recognized in the current fiscal year.

-

* 3 The maximum amounts of remuneration, etc. are as follows:

(1) Maximum aggregate amount of monetary remuneration, etc., to be paid to Directors:

An annual amount of 630 million yen (as resolved at the 101st Annual General Meeting of Shareholders held on June 28, 2007). The Company had 15 Directors (including two Outside Directors) at the conclusion of this Annual General Meeting of Shareholders. Such maximum aggregate amount includes the maximum annual amount of 100 million yen to be paid to Outside Directors (as resolved at the 110th Annual General Meeting of Shareholders held on March 25, 2016) but does not include the salary amounts, etc. to be paid to Directors who also serve as employees of the Company, for their service as employees. The Company had seven Directors (including three Outside Directors) at the conclusion of this Annual General Meeting of Shareholders.

Based on a resolution adopted at the 118th Annual General Meeting of Shareholders held on March 22, 2024, the Company has introduced a performance-based share incentive plan for its Directors (excluding Outside Directors) and its Executive Officers, which shall be applicable separately from the maximum aggregate amount of monetary remuneration, etc., for Directors. Under this share incentive plan, trust money of up to 4.64 billion yen is contributed during the fiscal years subject to the Company’s mid-term plan (the initial period to be covered being the period of four fiscal years from the fiscal year ended December 31, 2024 to the fiscal year ending December 31, 2027), and the Company’s shares are acquired through a trust and are then vested, etc., through the trust, based on the evaluation indicators consisting of Business Growth Evaluation indicators (such as the degree of growth in overall business sales, profit, and EVA), ESG Activities Evaluation indicators (such as evaluation by external indicators and status of realization of internal indicators), and Top Management Activities Evaluation indicators (such as TSR (Total Shareholder Return) and evaluation of management activities by the Company’s employees). The Company had four Directors (excluding Outside Directors) at the conclusion of this Annual General Meeting of Shareholders.

(2) Maximum aggregate amount of remuneration, etc., to be paid to Audit & Supervisory Board Members:

An annual amount of 180 million yen (as resolved at the 118th Annual General Meeting of Shareholders held on March 22, 2024). The Company had five Audit & Supervisory Board Members (including three Outside Audit & Supervisory Board Members) at the conclusion of this Annual General Meeting of Shareholders. -

* 4 Aggregate amount of remuneration, etc. paid to Outside Directors and Outside Audit & Supervisory Board Members by the Company’s subsidiaries, etc., other than the aggregate amount of remuneration, etc. paid to Outside Directors and Outside Audit & Supervisory Board Members:

Remuneration paid to one Outside Audit & Supervisory Board Member for his service as an Audit & Supervisory Board Member of Kao Group Customer Marketing Co., Ltd. was 4 million yen.

Compensation Paid for Individual Directors in FY2024

| Name (title) |

Aggregate amount of remuneration, etc. (millions of yen) |

Company category |

Amount of remuneration by type (Millions of yen) | |||

|---|---|---|---|---|---|---|

| Base salary | Short-term incentive compensation (performance-based bonus) |

Long-term incentive compensation (performance-based share incentive plan) |

||||

| Variable portion | Fixed portion | |||||

| Yoshihiro Hasebe (Director) |

297 | Reporting company |

87 | 112 | 69 | 29 |

| Masakazu Negoro (Director) |

128 | Reporting company |

49 | 43 | 25 | 11 |

| Toru Nishiguchi (Director) |

127 | Reporting company |

48 | 43 | 25 | 11 |

| David J. Muenz (Director) |

164 | Reporting company |

112 | 9 | 30 | 13 |

-

* 1 The variable portion of the long-term incentive compensation (performance-based stock compensation) will be determined at the end of the final fiscal year of the four fiscal years from 2024 to 2027, which are subject to our mid-term management plan “K27.” Therefore, the variable portion will be recorded as an accrued amount for the current fiscal year.

-

* 2 The table above includes information only on those whose aggregate remuneration, etc. exceeds 100 million yen.

- Home

- About Kao

- Our Core of Management

- Corporate Governance

- Compensation System for Directors, Audit & Supervisory Board Members and Executive Officers

- Home

- About Kao

- Our Core of Management

- Corporate Governance

- Compensation System for Directors, Audit & Supervisory Board Members and Executive Officers